Retirement Planning and Employee Benefits 18th Edition PDF provides a comprehensive and authoritative guide to help individuals plan for a secure and fulfilling retirement. This invaluable resource offers expert insights into retirement planning strategies, employee benefits, tax implications, estate planning, and case studies of successful retirement planning.

Whether you’re just starting to think about retirement or are already in the planning stages, this book is an indispensable tool that will empower you to make informed decisions and maximize your retirement savings.

Retirement Planning Strategies: Retirement Planning And Employee Benefits 18th Edition Pdf

Retirement planning is the process of preparing financially for the day when you stop working and enter retirement. It involves saving and investing money to ensure that you have a secure financial future. There are many different retirement planning strategies available, and the best approach for you will depend on your individual circumstances and goals.

One of the most important things you can do when planning for retirement is to start saving early and save consistently. The sooner you start saving, the more time your money has to grow and compound. Even small amounts of money saved regularly can add up to a substantial nest egg over time.

There are many different types of retirement accounts available, each with its own advantages and disadvantages. Some of the most common types of retirement accounts include 401(k)s, IRAs, and annuities.

401(k)s

- Employer-sponsored retirement plans that allow employees to save for retirement on a pre-tax basis.

- Contributions are deducted from your paycheck before taxes are taken out, so you pay less in taxes now.

- The money in your 401(k) grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw the money in retirement.

IRAs, Retirement planning and employee benefits 18th edition pdf

- Individual retirement accounts that allow you to save for retirement on a tax-advantaged basis.

- There are two main types of IRAs: traditional IRAs and Roth IRAs.

- Traditional IRAs allow you to deduct your contributions from your taxes now, but you pay taxes on the earnings when you withdraw the money in retirement.

- Roth IRAs allow you to make contributions with after-tax dollars, but you don’t pay taxes on the earnings when you withdraw the money in retirement.

Annuities

- Insurance contracts that provide you with a guaranteed income stream for life.

- You can purchase an annuity with a single premium or with regular payments over time.

- Annuities can be a good way to ensure that you have a secure income in retirement, but they can also be expensive.

FAQ Insights

What are the key retirement planning strategies?

Key retirement planning strategies include starting early, saving consistently, and diversifying investments. It’s also important to understand the different types of retirement accounts, such as 401(k)s, IRAs, and annuities.

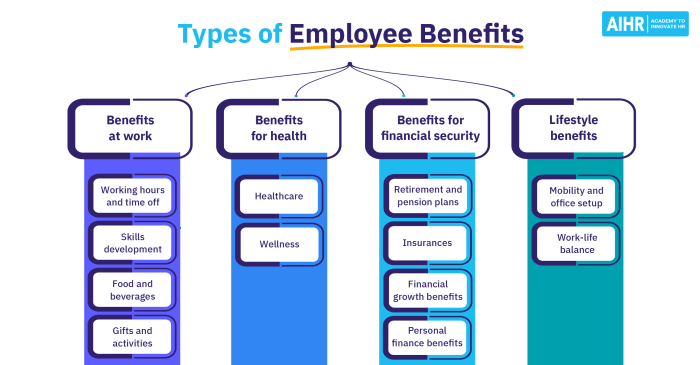

What are the different types of employee benefits?

Common employee benefits include health insurance, dental insurance, life insurance, paid time off, and retirement benefits. It’s important to understand the terms and conditions of your employee benefits and negotiate for the best possible benefits package.

How can I minimize taxes on my retirement income?

There are several strategies for minimizing taxes on retirement income, such as contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs. It’s also important to understand the tax implications of different types of retirement income.